AutoLooks 2021 Year End Review

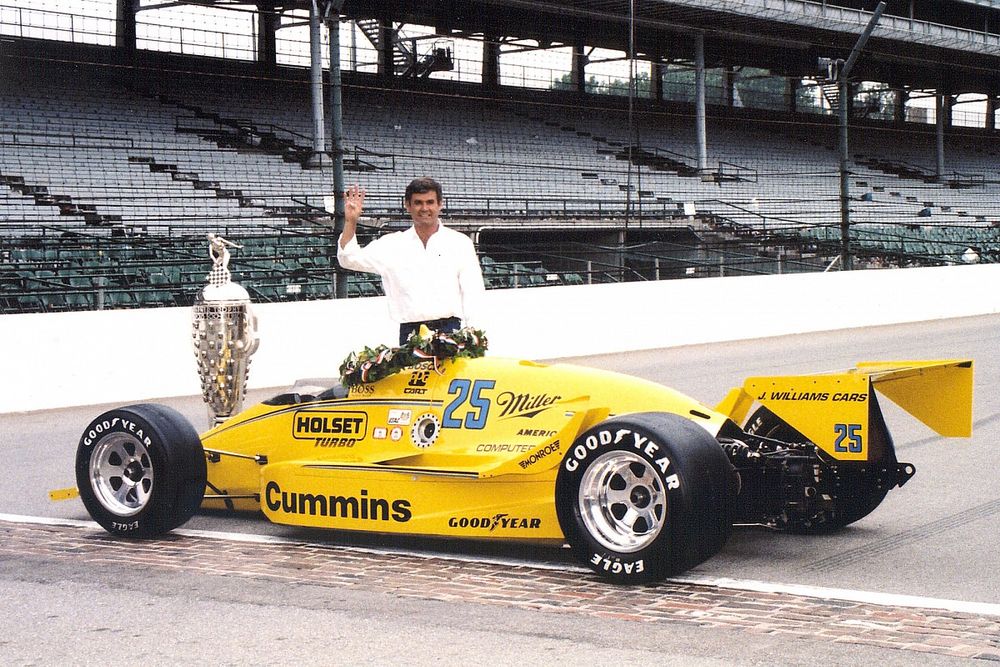

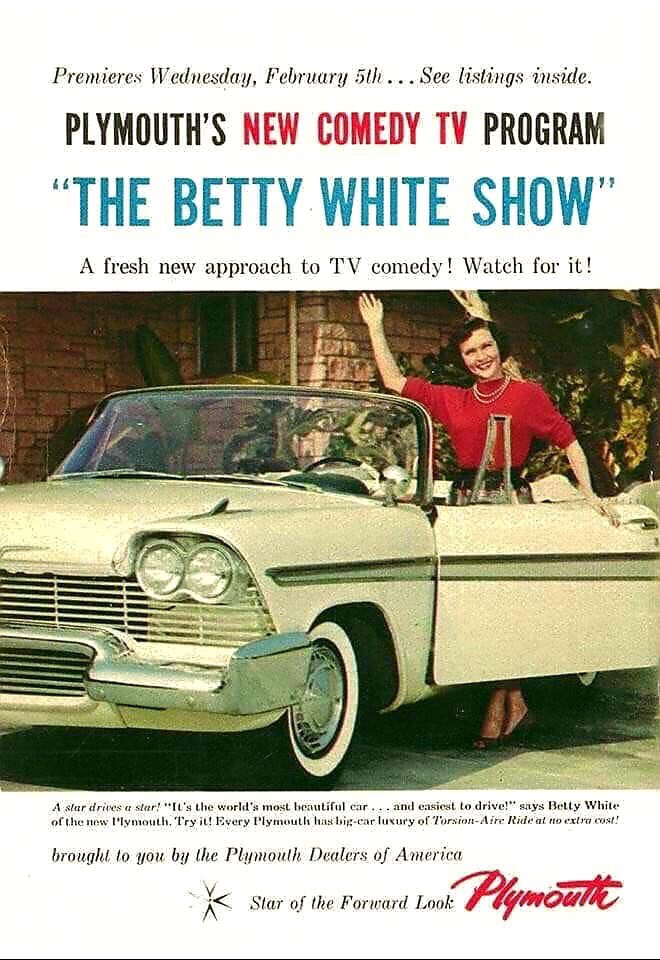

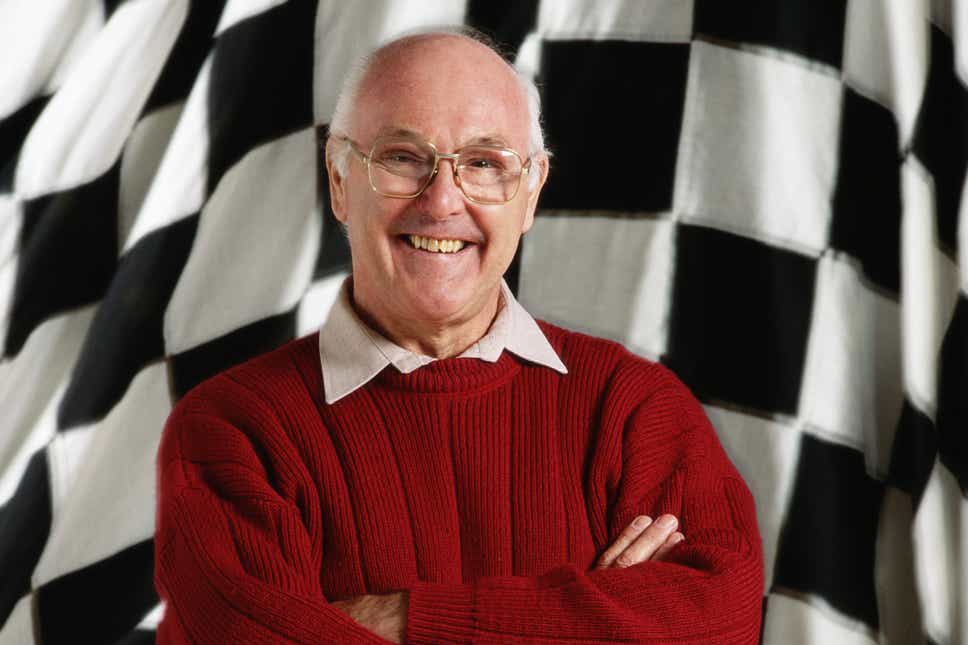

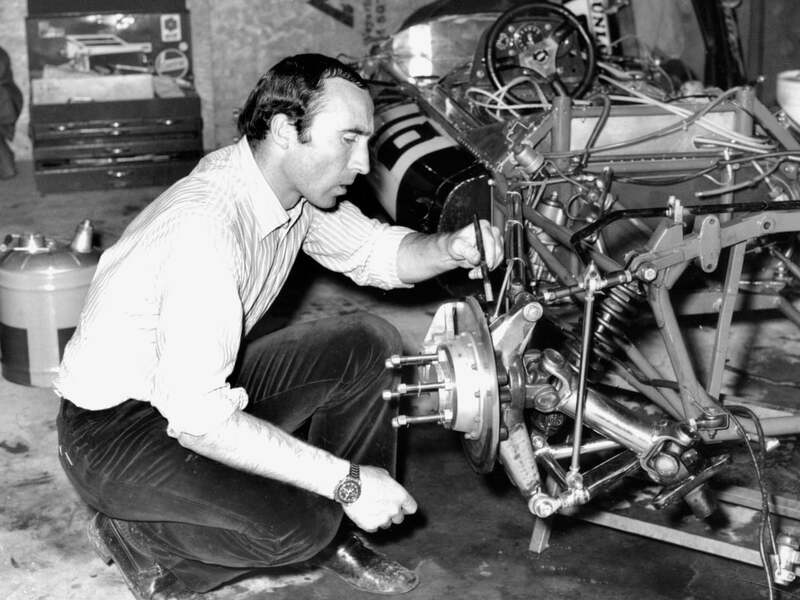

tricks up their sleeve. For now we can only hold onto our growling V8's as their future is nearing the end. But, don't expect it anytime soon. With a new interest into alternative fuel vehicles, it was no wonder that the hottest stocks for 2021 were from the EV section of the automotive market. Tesla, Rivian, Nio, Xpeng, Sono Motors and Lucid have seen early growth in their stocks. Most released their stock options this fall and when released their was a buying frenzy. This shot up the valuations for most EV makers, but with limited deliveries and a market that is drying up, most of these stocks have dropped. Some more than others (Rivian). 2021 became another year of losses, as we lost some great people and again lost a few auto shows. Most only closed up for the year due to COVID, but a few of them have decided to close up for good. This comes as no surprise as the automotive world is moving away from direct shows, to moving to virtual ones. Images are good, but nothing beast the smell and feeling of a new vehicle. One of the great additions to the industry this year, was a renewed interest into fuel cell technology. This has increased visibility for companies like Nickola, H2X, Toyota, Hyundai and Next Hydrogen. Having an alternative to EV is good for the market and could prove to be a better choice for some markets. It's only downside is that most countries are only pushing EV infrastructure. Both Canada and the U.S. have a nationwide push for more charging stations. This is a benefit to Electrify America and has pushed Shell and Petro Canada into providing charging stations. Although Shell is playing on the side of caution as they are setting up both hydrogen and EV refueling posts. This could prove to be beneficial to them and help push both power sources to a larger crowd. Besides a rush to green products, the automotive world did see a drop in the availability of products due to an ongoing chip shortage. This seems to be the starting point for North America to move away from their Asian reliance for these and other products for the green industry. Great news for mining in North America and even a few small towns, as even one close to home is betting on winning the day to provide products for this growing industry. A drop in available coupes and convertibles saw its lowest of low, with only three (3) new products between both segments. Two (2) of them were CUV's as well. This is a major sign that sports cars could be on their way out along with wagons, as these markets have seen slow growth this year. In the end 2021 will be a year to remember, as this was the year that many parts of the automotive industry made major changes. From a chip shortage to an explosion of EV sales, the auto industry saw its biggest change yet. As we move into the future our mobility needs will change and only companies who are on top of it now will survive the end of this decade. All the best to the auto industry in 2023 and we a looking forward to all of its changes. Everett J. #autolooks 2021 Year End Review A+ Vehicles for 2022: 11/559 (2%) Rusty Vehicles for 2022: 58/559 (10%) CopyCat Vehicles for 2022: 20/559 (4%) Companies Rated: 165 Average Score: 54.72% (C) Most new vehicles: Toyota with 29 (5%) new or updated models A+ Segment: High Performance - 78.96% Rusty Segment: Hatchback - 45.59% Audi: 12 new models - 53.07% avg. BMW: 16 new models - 51.99% avg. Buick: 5 new models - 58.29% avg. Byd: 7 new models - 53.49% avg. Changan: 5 new models - 56.58% avg. Chery: 5 new models - 54.63% avg. Chevrolet: 7 new models - 54.75% avg. Fiat: 5 new models - 49.36% avg. Ford: 27 new models - 54.85% avg. Geely: 7 new models - 58.25% avg. GMC: 6 new models - 56.95% avg. Haval: 7 new models - 52.23% avg. Honda: 18 new models - 50.12% avg. Hyundai: 17 new models - 58.91% avg. Jeep: 13 new models - 60.91% avg. Kia: 18 new models - 55.39% avg. Lexus: 10 new models - 62.74% avg. Mercedes-Benz: 11 new models - 52.96% avg. MG: 7 new models - 58.85% avg. Mini: 7 new models - 47.73% avg. Mitsubishi: 6 new models - 54.18% avg. Nissan: 15 new models - 50.98% avg. Opel/Vauxhall: 5 new models - 51.88% avg. ORA: 5 new models - 48.44% avg. Peugeot: 5 new models - 50.10% avg. Porsche: 5 new models - 54.93% avg. Roewe: 9 new models - 54.02% avg. Sehol: 6 new models - 52.95% avg. Skoda: 8 new models - 58.41% avg. Subaru: 10 new models - 50.87% avg. Toyota: 29 new models - 52.89% avg. Volkswagen: 20 new models - 51.61% avg. Wuling: 5 new models - 47.46% avg. Remembering Who We Lost in 2021 Welcoming a Few New Companies Want to see more from these companies, check out our Corporate Links page. Viewers Choice Award AutoLooks will see you in 2023 with more podcasts, videos, rating blogs and something new.

0 Comments

Leave a Reply. |

FOLLOW US ON SOCIAL MEDIA:

Copyright Ecomm 2004-2023